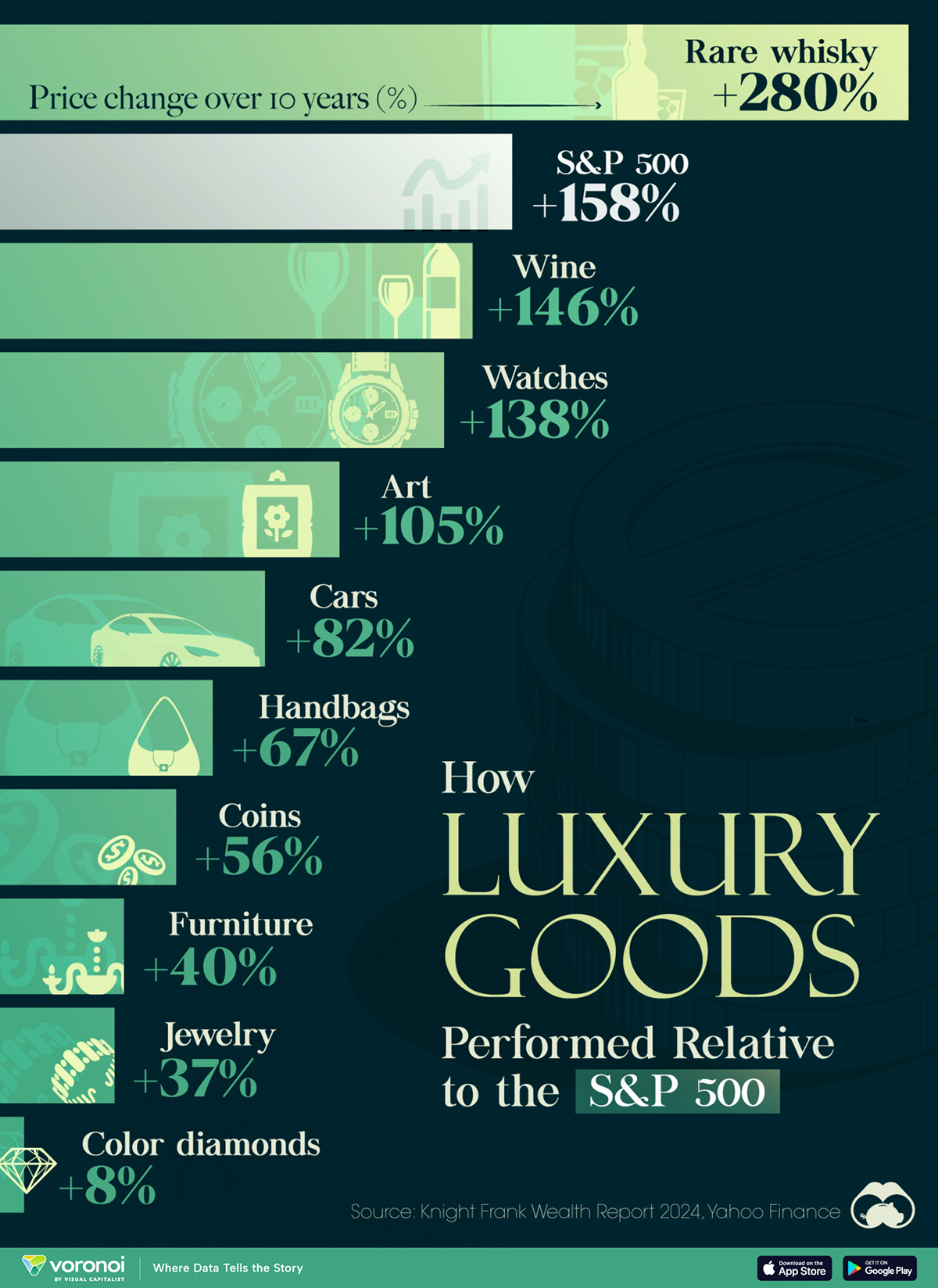

Charted: Luxury Goods Investments vs. S&P 500 in the Last 10 Years

How does investing in luxury goods like expensive watches and rare whisky compare to other goods, or to the S&P 500?

www.visualcapitalist.com

www.visualcapitalist.com

Charted: Luxury Goods Investments vs. S&P 500 in the Last 10 Years

How does investing in luxury goods like expensive watches and rare whisky compare to other goods, or to the S&P 500?

www.visualcapitalist.com

www.visualcapitalist.com

| Asset | Price Change (Q4 2013–23) |

|---|---|

| S&P 500 | +158% |

Over the past 10 years, rare whisky (or whiskey, depending on where it was made) has been the best performing luxury asset, appreciating by 280% and even besting the S&P 500.

Last edited: